(CNBC Indonesia/ Andrean Kristianto)

Jakarta, CNBC Indonesia – The Meikarta megaproject case which has recently surfaced again has brought the Lippo Group into the spotlight. Once referred to as the signature project , now Meikarta has left a conflict that has yet to end.

In fact, the megaproject located in South Cikarang, Bekasi Regency, had become the big hope of the two Lippo Group property companies made by the Riady Family, PT Lippo Karawaci Tbk (LPKR) and PT Lippo Cikarang Tbk (LPCK) when they were launched in 2017.

” Meikarta is a real masterpiece to arouse buyers’ interest. Meikarta is the first giant project built by the Lippo Group after 67 years,” said the optimism written in LPKR’s 2017 Annual Report.

In 2017, many pages in the national print media presented large-scale advertisements for the sale of apartments in the city of Meikarta. Likewise, if you visit malls owned by the Lippo Group, there will be sales counters in the city of Meikarta.

The marketing research institute Nielsen revealed that throughout 2017 advertising spending in Indonesia increased. One of them is thanks to Meikarta’s contribution, which reached more than IDR 1.5 trillion.

This optimism had spread among stock analysts. An equity research on LPKR published on May 26 2017 stated that the Meikarta project – which is projected to be a success – could ease concerns over Lippo’s balance sheet .

The rating agency ( rating ) Fitch also mentioned in the announcement of the rating on November 30 2017, Meikarta would make LPCK’s contribution “to consolidated cash flows [in LPKR] to increase significantly in the coming years.”

It’s just that the ‘megacity’ project that targets the lower middle class has encountered many problems even a year after it was launched, starting from licensing and spatial planning issues, licensing bribery cases involving the Bekasi government, being sued by vendors, to the end of the project being stalled to date.

Most recently, as many as 21 members of the Indonesian Parliament last Tuesday (14/2/2023) directly inspected Meikarta over complaints from consumers.

On that occasion, DPR Deputy Speaker Sufmi Dasco Ahmad, who led the group, revealed that there were around 130 consumers who wanted their money back because the unit construction had not been completed.

For information, Lippo Karawaci had directly held 83.99% of the shares in Lippo Cikarang until the end of 2021, before in the first quarter of 2022 LPKR’s ownership in LPCK was transferred to LPKR’s subsidiary, PT Kemuning Satiatama (with an 80.83% share).

Meanwhile, PT Mahkota Sentosa Utama (MSU) is the developer from Meikarta. In the past, MSU was consolidated into the financial statements of LPCK and LPKR, before LPCK finally released IDR 2.02 trillion of shares as the controlling shareholder of MSU in 2018.

Indeed, if you look at the May 2018 report, it is said that Meikarta is no longer included in the property development portfolio of the Lippo Group.

The financial report as of September 30 2022 shows that LPCK stated that prior to the loss of control over MSU, the company recorded a difference in investment value of Rp.4.04 trillion in MSU as another component of equity for the disposal of its share of investment ownership in MSU.

After the divestment action, LPCK’s ownership in MSU reached IDR 2.01 trillion. However, LPCK’s ownership in MSU still remains 49.72%.

Along with the deconsolidation of MSU, LPCK also stated that it has no responsibility for Meikarta consumers.

“We can say that fulfilling the consumer rights of the Meikarta apartment and fulfilling the handover target are the full responsibility of PT Mahkota Sentosa Utama (MSU),” said LPCK Corporate Secretary Veronika Sitepu in an information disclosure, quoted Monday (18/2/2023).

Stock Drops, Losses Yearly

Meikarta, yang diharapkan menjadi tonggak baru Lippo dan mampu menambah arus kas perusahaan, malah berujung polemik. Seiring seretnya likuiditas dan kasus suap pada 2018, lembaga rating macam Fitch and Mood’s pun melakukan penurunan peringkat (downgrade) kredit LPKR.

Apalagi pasar properti yang lesu pasca-boom property 2010-2013, era suku bunga tinggi 2018, ditambah pandemi Covid-19 2020, semakin menambah pukulan untuk properti Lippo.

Ibarat sebuah ‘badai sempurna’ alias perfect storm, hal tersebut mengirim saham-saham properti turun ke teritorial yang dalam. Bertahun-tahun, harga saham properti, termasuk milik Lippo, tidak manggung.

Saham sektor properti (IDXPROPERT), misalnya, anjlok 8,00% sepanjang 2022, peringkat ketiga indeks saham terburuk di tahun itu.

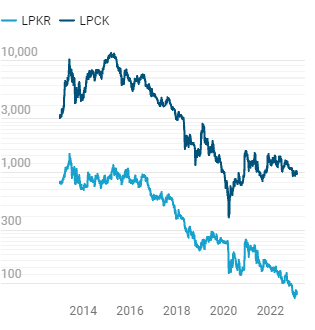

Saham LPCK, khususnya, sempat menembus level Rp9.800-an pada 2013 dan Rp11.000-an 2015, kini diperdagangkan di harga Rp960/saham, per 20 Februari 2023.

Sementara, saham LPKR sempat berada di level Rp1.400-an pada 2013, sekarang jauh terbenam di harga Rp80/saham.

Kinerja Saham LPCK dan LPKR

LPCK’s profits have not gone anywhere after the turnaround from losses in 2021. Meanwhile, LPKR has been bearing losses since 2019 or for 4 consecutive years.

During the year of the pandemic, the losses for both of them swelled, LPCK net lost Rp. 3.65 trillion, while LPKR lost Rp. 8.89 trillion.

Laba/Rugi Bersih LPCK dan LPKR Sejak 2013

Source: Refinitiv (diolah) Created with Datawrapper

The debt ratio of the Lippo property duo, especially LPKR, is also worrying. The debt-to-EBITDA ratio or debt compared to earnings before interest, taxes, depreciation and amortization reaches LPKR 21.01 (annualized).

This figure is far above its peers . The higher the ratio, the more likely the company will have difficulty paying debts going forward.

Meanwhile, LPCK’s debt/EBITDA reached 6.20 times (annualized).

In comparison, the debt/EBITDA of the property company PT Bumi Serpong Damai Tbk (BSDE) was 9.29 times, PT Pakuwon Jati Tbk (PWON) 2.94 times, PT Summarecon Agung Tbk (SMRA) 9.19 times, PT Intiland Development Tbk (DILD) 16.65 times, PT Agung Podomoro Land Tbk (APLN) 3.07 times, and PT Ciputra Development Tbk (CTRA) 6.08 times.

This in turn made investors think about investing in LPCK and LPKR shares.

CNBC INDONESIA RESEARCH

Disclaimer: This article is a journalistic product in the form of the views of CNBC Indonesia Research, the research division of CNBC Indonesia. This analysis does not aim to persuade readers to buy, hold, or sell related investment sector products or assets. The decision is entirely up to the reader, so we are not responsible for any losses or profits that arise from that decision.

Source: CNBC