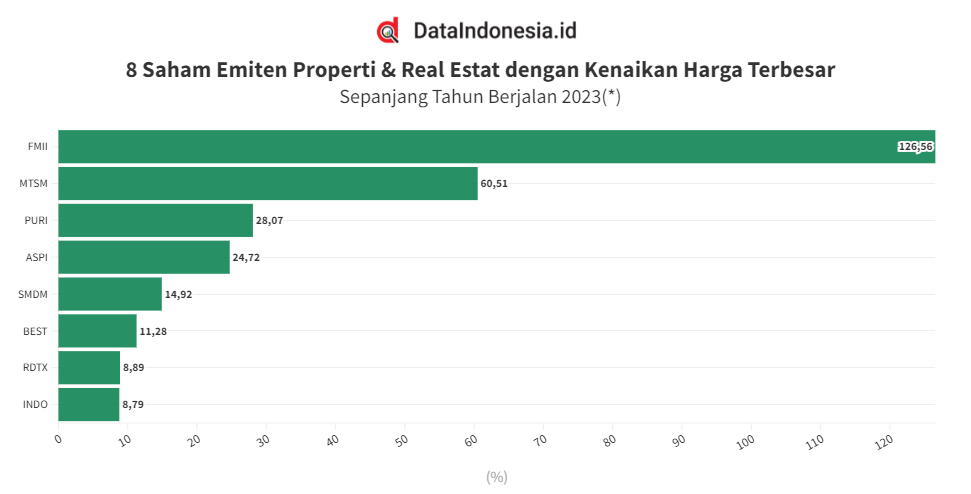

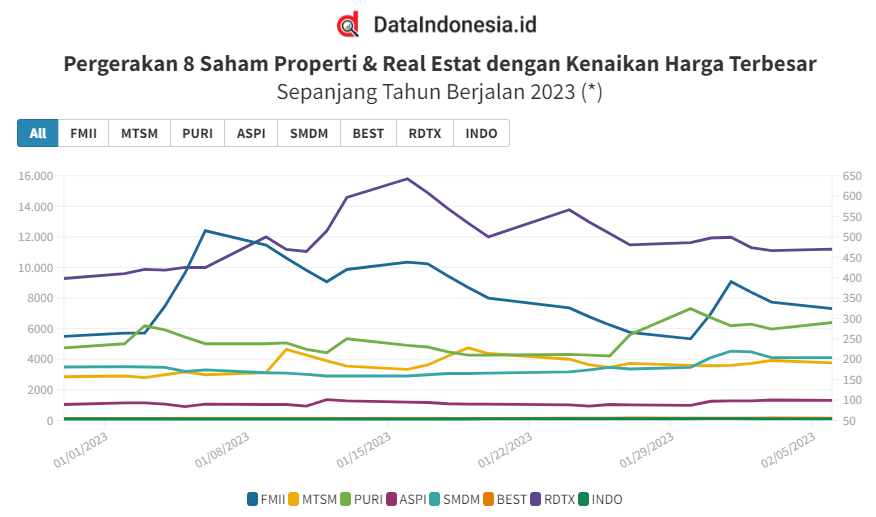

As many as 24 stocks operating in the property and real estate sector are observed to be moving in the green zone throughout 2023. The top position is occupied by shares of PT Fortune Mate Indonesia Tbk. (FMII) whose share price skyrocketed by 126.56% (ytd).

(*) Per 27 Februari 2023

The property industry is starting to revive. This occurred in the midst of a sloping pandemic that has made people’s activities increase again and consumers’ purchasing power is also maintained. Even so, the rate of recovery was indeed not very fast.

Quoting Bisnis.com, the property search trend for prices above IDR 1 billion is reported to continue to increase. A number of areas in Greater Jakarta continued to show positive trends in the fourth quarter, such as the Tangerang and Bogor Regencies.

Data from Rumah.com Indonesia Property Market Report Q1 2023 shows the price index edged up by 1% on a quarterly basis in the fourth quarter of 2022, and the supply index increased slightly by 0.3%.

Meanwhile, in the same period the residential property demand index showed a decline of up to 40.4% on a quarterly basis. Rumah.com Country Manager Marine Novita said that the decline in the demand index was a seasonal trend accompanied by an increase in benchmark interest rates and global macroeconomic conditions.

In the midst of a recovery period, a number of stocks in the property sector showed mixed movements. Based on monitoring by DataIndonesia.id, the property and real estate sector index still experienced a correction of 2.2% on a current year (ytd) basis to a level of 695 until the close of trading on Monday (27/2).

Of the 85 stocks operating in the property and real estate sector, 24 issuers recorded price increases throughout 2023. However, as many as 25 shares were recorded as stagnant and 36 other shares experienced corrections.

Meanwhile, of the 24 stocks moving into the green zone, PT Fortune Mate Indonesia Tbk. (FMII) is listed as the most successful property and real estate issuer. FMII’s shares soared 126.56% (ytd) to a level of 580 at the close of trading earlier this week from their closing position at the end of last year, December 30, 2022, at level 256. On Monday (27/2), FMII’s shares were recorded as having a market capitalization of Rp. 58 trillion with a transaction value of IDR 48.23 million.

Under FMII there are shares of PT Metro Realty Tbk. (MTSM) with an increase in share prices throughout 2023 running by 60.51% (ytd) to position 252 as of Monday (27/2). MTSM’s market capitalization is in the position of IDR 58.68 billion with a transaction value of IDR 231.73 million.

(*)Per 27 Februari 2023

Next, there are shares of PT Puri Global Sukses Tbk. (PURI) which jumped 28.07% (ytd) to a level of 292. PURI shares recorded a market capitalization of IDR 292 billion. Followed by shares of PT Andalan Sakti Primarindo Tbk. (ASPI), which is perched at the 111 level, experienced an appreciation of 24.72% (ytd). ASPI shares have a market capitalization of IDR 75.68 billion.

Furthermore, there are shares of PT Suryamas Dutamakmur Tbk. (SMDM) which advanced to the green zone 14.92% (ytd) to level 208. Then the shares of PT Bekasi Fajar Industrial Estate Tbk. (BEST) rose 11.28% (ytd) to 148. In seventh position there are shares of PT Roda Vivatex Tbk. (RDTX) with a share price increase of 8.89% (ytd) to the level of 10,100. The final positions of the eight most profitable property and real estate stocks were occupied by PT Royalindo Investa Wijaya Tbk. (ENG). Throughout 2023, INDO shares have climbed 8.79% (ytd) to a level of 99.

Meanwhile, a number of property stocks with jumbo market capitalization have also advanced in the green zone this year. Shares of PT Pakuwon Jati Tbk. (PWON), for example, recorded a gain of 1.32% (ytd) to a level of 462. Then shares of PT Bumi Serpong Damai Tbk. (BSDE) shares rose 3.26% (ytd) to the level of 950, and shares of PT Ciputra Development Tbk. (CTRA) also still strengthened 5.32% (ytd) to 990.

Source: data indonesia